A check is a written, dated, and signed instrument that directs a bank to pay a specific sum of money to a payee. When you write a check, you are requesting that the bank pay the recipient the amount of money specified on the check. The recipient can then present the check to their bank, which will transfer the funds from your account to their account.

Checks are a common way to make payments in the United States and many other countries. They are generally considered to be a more secure and formal way to pay than cash, as they provide a written record of the transaction.

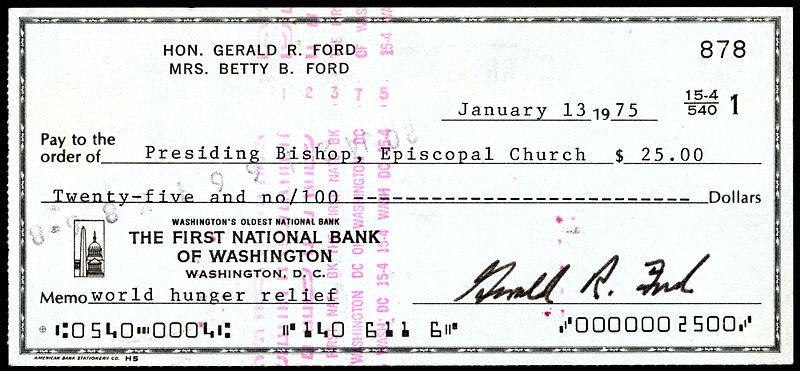

What Is On Check

A check is a written, dated, and signed instrument that directs a bank to pay a specific sum of money to a payee. There are several pieces of information that are typically found on a check:

- The date: This is the date that the check is written.

- The payee: This is the name of the person or business that the check is payable to.

- The dollar amount: This is the amount of money that the check is for, written in numbers.

- The dollar amount in words: This is the amount of money that the check is for, written in words.

- The memo: This is a space on the check where you can write a note to yourself or the recipient about the purpose of the check.

- The signature: This is your signature, which is required to make the check valid.

- The routing number: This is a nine-digit code that identifies the bank where the check is drawn.

- The account number: This is the number that identifies your account at the bank.

- The check number: This is the number that identifies the check and helps you keep track of your checks.

- The bank’s name and address: This is the name and address of the bank where the check is drawn.

How to Transfer Money from PayPal to Bank – Simple Tutorial

How to Cancel a PayPal Payment – Simple Tutorial

How to void a check

To void a check means to cancel it so that it cannot be used for payment. Here are the steps you can follow to void a check:

- Write the word “VOID” in large, bold letters across the front of the check. This will make it clear that the check is no longer valid and cannot be used for payment.

- Cross out the recipient’s name and any other information on the front of the check, except for your signature and the date.

- Draw a line through the amount of the check, both in numbers and in words.

- If you have already signed the check, you will need to write “VOID” above your signature.

- Keep the voided check for your records. You may need to refer to it in the future if there is a question about the transaction.

Once you have voided the check, it can no longer be used for payment. If you need to make a payment, you will need to write a new check or use a different payment method.

how to write a check

Writing a check is a simple process that requires you to follow a few steps. Here is how to do it:

- Date the check. Write the current date on the line at the top right-hand corner of the check.

- Write the recipient’s name. On the “Pay to the Order of” line, write the name of the person or business you are paying.

- Write the dollar amount. On the line beneath the recipient’s name, write the dollar amount in numbers. For example, if you are writing a check for $100.50, you would write “100.50” on this line.

- Write the dollar amount in words. On the line beneath the dollar amount in numbers, write the dollar amount in words. For example, if you are writing a check for $100.50, you would write “one hundred and 50/100” on this line.

- Write a memo. In the memo field, you can write a note to yourself or the recipient about the purpose of the check. For example, you might write “rent” or “utilities.”

- Sign the check. At the bottom right-hand corner of the check, you will need to sign the check. Be sure to use your legal signature.

Once you have completed these steps, you can mail the check or give it to the recipient in person.