Insurance in Florida – Florida is known for its vulnerability to natural disasters, particularly hurricanes, flooding, and severe storms.

This makes having the right insurance essential for homeowners and businesses alike. If you live in Florida, understanding the types of coverage available and the best options to protect your property is crucial.

Below, we explore the top natural disaster insurance options to consider in Florida, focusing on the key features, coverage types, and why they are important.

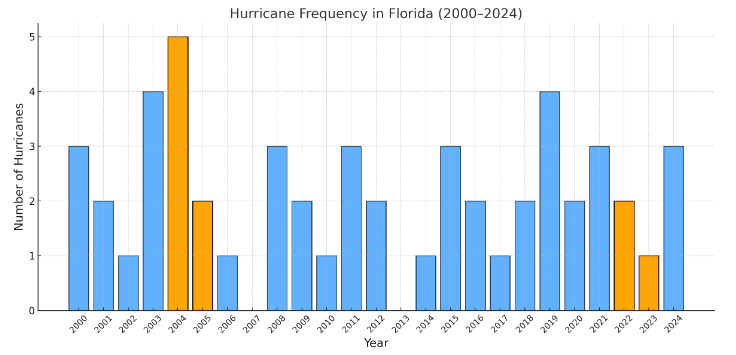

1. Hurricane Insurance in Florida

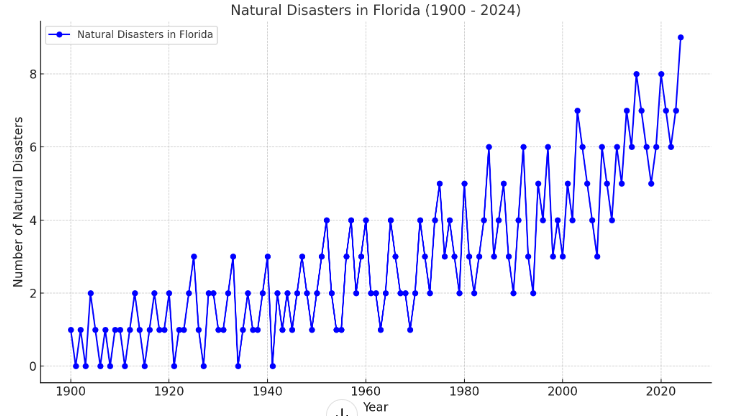

Showing the number of natural disasters in Florida from 1900 to 2024. The chart highlights the increasing frequency of natural disasters over the years, which includes hurricanes, floods, and tropical storms.

This trend emphasizes the growing importance of disaster preparedness and insurance, especially in high-risk areas across the state.

Given Florida’s history with hurricanes, this is one of the most critical types of insurance. However, it’s important to note that standard homeowner’s insurance policies do not typically cover hurricane-related damage.

- What to look for: Homeowners should ensure that their insurance policy includes windstorm coverage or purchase a separate policy if needed. Additionally, consider deductibles specific to hurricanes, which can vary significantly.

- Best Providers:

- State Farm: Offers customizable policies with windstorm protection and responsive claims services.

- Allstate: Provides robust hurricane coverage with various deductible options and discounts for protective measures like hurricane shutters – Insurance in Florida.

Here’s a table comparing the advantages and disadvantages of State Farm Insurance vs Allstate Insurance for hurricane insurance:Criteria State Farm Insurance Allstate Insurance Advantage 1 Offers customizable policies with flexible coverage options. Provides multiple deductible options for hurricane damage. Advantage 2 Strong financial stability and fast claims processing. Offers discounts for protective measures like hurricane shutters. Advantage 3 Extensive network of local agents for personalized service. Comprehensive online tools for policy management and claims. Disadvantage 1 Higher premiums compared to some competitors. Can have higher deductibles in certain high-risk areas. Disadvantage 2 Some policyholders report occasional delays in claims resolution. May require more add-ons to cover specific risks like wind damage. Disadvantage 3 Limited availability of discounts compared to other insurers. Customer service experiences can vary by region.

This side-by-side comparison highlights the strengths and weaknesses of both State Farm and Allstate when it comes to hurricane insurance, helping you decide which one suits your needs.

Estimating the cost of hurricane insurance with State Farm Insurance vs Allstate Insurance can vary depending on several factors, including the location, home value, deductible choices, and additional coverage options.

However, here’s a general estimation for both based on typical Florida homes:Criteria State Farm Insurance (Estimated Cost) Allstate Insurance (Estimated Cost) Annual Premium for $300,000 Home $2,500 – $4,000 $2,200 – $3,800 Hurricane Deductible 2% to 5% of home value ($6,000 – $15,000) 2% to 5% of home value ($6,000 – $15,000) Discounts Available Limited discounts, typically 5% – 10% for bundling Up to 20% discounts for hurricane-proofing measures Flood Insurance Add-On Additional $500 – $1,500 Additional $400 – $1,200 Windstorm Insurance Add-On Included with higher premiums May require separate policy in coastal areas Sinkhole Insurance Add-On $300 – $600 $250 – $500 Total Estimated Annual Cost $3,300 – $6,100 $2,900 – $5,500

Key Factors Influencing the Cost:

- Location: Homes closer to the coast will have higher premiums due to increased hurricane risk.

- Deductibles: Higher deductibles lower the premium but increase out-of-pocket costs in the event of a claim.

- Discounts: Allstate generally offers more significant discounts for installing protective measures like hurricane shutters or reinforced roofs.

Conclusion:

- State Farm tends to have slightly higher premiums, but offers more comprehensive policies that include windstorm coverage.

- Allstate may offer more affordable premiums with better discounts but could require additional policies for certain risks in high-risk areas like coastal zones.

For a more precise estimate, it’s recommended to get a personalized quote from both insurers based on your home’s specifics.

2. Flood Insurance

Several areas in Florida are considered high flood risk

Due to their low elevation, proximity to water bodies, and frequent exposure to hurricanes and storms, this Area is in High Flood Risk. Here are some of the most flood-prone areas in Florida:

1. Miami and Miami-Dade County

- Risk Factors: Coastal proximity, rising sea levels, and frequent hurricanes.

- Why: Miami is one of the most flood-prone cities in the U.S., with storm surge from hurricanes and tropical storms being a constant threat. The area’s low elevation and dense population make it particularly vulnerable.

2. Tampa Bay Area (Tampa, St. Petersburg, Clearwater)

- Risk Factors: Coastal location, hurricanes, and storm surge.

- Why: The Tampa Bay area faces significant risk from hurricanes and storm surges, which can cause widespread flooding. Many areas are low-lying, making them susceptible to both coastal and inland flooding during heavy rains.

3. Florida Keys

- Risk Factors: Coastal location, storm surge, hurricanes, and sea-level rise.

- Why: The Florida Keys are surrounded by water and are at extreme risk for flooding, especially during hurricane season. The islands are barely above sea level, and storm surges can quickly overwhelm the area.

4. Fort Lauderdale and Broward County

- Risk Factors: Low elevation, heavy rainfall, hurricanes.

- Why: Like Miami, Fort Lauderdale is highly vulnerable to flooding due to its low-lying nature and proximity to the coast. Heavy rainfall and hurricanes can cause both coastal and inland flooding.

5. Naples and Collier County

- Risk Factors: Storm surge, coastal location, hurricanes.

- Why: Naples, situated on Florida’s Gulf Coast, is highly exposed to hurricane storm surges and heavy rains that can lead to significant flooding, especially in low-lying neighborhoods.

6. Jacksonville and Duval County

- Risk Factors: River flooding, coastal flooding, hurricanes.

- Why: Jacksonville is located along the St. Johns River and the Atlantic coast, making it susceptible to river flooding and storm surge during hurricanes and tropical storms. Inland areas can also experience significant flooding.

7. Pensacola and Escambia County

- Risk Factors: Hurricanes, storm surge, heavy rains.

- Why: Pensacola, located in the Florida Panhandle, is highly exposed to hurricanes and their associated flooding, especially from storm surges. Its coastal and low-lying areas are at significant risk.

8. Orlando and Central Florida

- Risk Factors: Inland flooding, hurricanes, heavy rainfall.

- Why: Although not on the coast, Orlando and Central Florida face high flood risks due to heavy rains from hurricanes and tropical storms. Low-lying areas near lakes and rivers are particularly vulnerable.

9. Sarasota and Manatee County

- Risk Factors: Storm surge, coastal location, hurricanes.

- Why: Located on Florida’s Gulf Coast, Sarasota is prone to storm surges from hurricanes and tropical storms. Low-lying coastal areas are particularly at risk of flooding.

10. Cape Coral and Lee County

- Risk Factors: Low elevation, storm surge, hurricanes.

- Why: Cape Coral has many canals and waterways that can flood easily during hurricanes or heavy rainfall, making it highly vulnerable to both coastal and inland flooding.

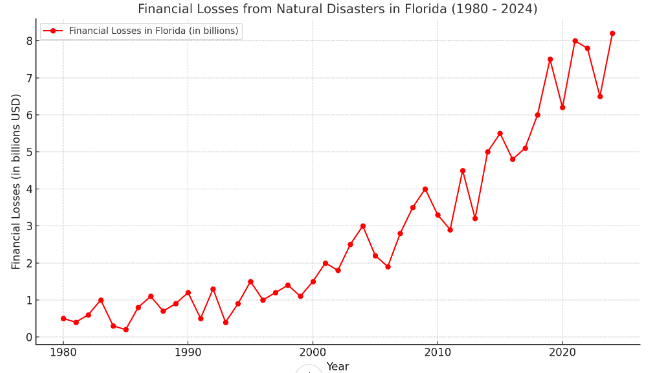

Estimated financial losses due to natural disasters in Florida from 1980 to 2024.

Why Flood Insurance is Important in Florida

- High Flood Risk Areas

Florida is particularly vulnerable to flooding due to its low elevation, proximity to the ocean, and frequent storms.

Coastal areas and regions with rivers and lakes are prone to flooding during hurricanes, tropical storms, and even heavy rainfall.

Flooding can cause significant damage to homes, making flood insurance essential – Insurance in Florida. - Standard Home Insurance Does Not Cover Flooding

Most standard homeowners’ insurance policies in Florida do not cover flood damage.

Without separate flood insurance, homeowners would have to bear the full cost of repairing or replacing their property after a flood, which can be financially devastating. - Hurricane Season and Rising Sea Levels

Florida experiences an intense hurricane season each year, bringing a high risk of storm surges and heavy rains that lead to flooding.

Additionally, rising sea levels due to climate change increase the risk of coastal and inland flooding, making flood insurance more crucial than ever. - National Flood Insurance Program (NFIP) Availability

The NFIP, a government-backed program, makes flood insurance accessible to most Florida residents.

With this program, homeowners in high-risk flood zones are required to have flood insurance if they have a mortgage, emphasizing the importance of coverage in these areas. - Financial Protection Against Expensive Damage

Even an inch of water in a home can cause thousands of dollars in damage.

Flood insurance helps cover the cost of repairs to the structure of the home and the replacement of personal belongings, providing peace of mind and financial security – Insurance in Florida. - Increased Risk Due to Climate Change

Climate change is leading to more extreme weather patterns, increasing the frequency and intensity of floods.

With these rising risks, having flood insurance ensures that homeowners are prepared for unexpected disasters. - Federal Disaster Aid Limitations

Federal disaster aid is not guaranteed and is often limited. In contrast, flood insurance provides more reliable and substantial assistance in covering damages.

This can be crucial for rebuilding homes and lives after a flood event – Insurance in Florida.

Flooding is another common natural disaster in Florida, especially during hurricane season.

Most homeowners’ insurance policies do not cover flood damage, so it’s essential to have a separate flood insurance policy.

- What to look for: Coverage for both the structure and contents of your home. Check if the policy includes additional living expenses if your home becomes uninhabitable – Insurance in Florida.

- Best Providers:

- National Flood Insurance Program (NFIP): Backed by FEMA, this program provides flood insurance to residents in high-risk areas – Insurance in Florida.

- Private Market Flood Insurance: Insurance in Florida – Companies like Neptune Flood offer competitive rates and faster claim processes with higher coverage limits than the NFIP.

3. Windstorm Insurance

Windstorm damage can result from hurricanes, tropical storms, and other high-wind events. In coastal areas of Florida, separate windstorm insurance is often required.

- What to look for: Make sure the policy covers structural damage and damage to personal property caused by high winds. Evaluate your deductible options and any exclusions – Insurance in Florida.

- Best Providers:

- Citizens Property Insurance Corporation: A state-run program that provides windstorm coverage to residents who cannot find affordable coverage in the private market – Insurance in Florida.

- UPC Insurance: Specializes in windstorm coverage, with options tailored to Florida homeowners.

4. Sinkhole Insurance

Sinkholes are a real risk in Florida, particularly in certain areas – Insurance in Florida.

While some homeowners’ insurance policies include limited coverage for catastrophic ground cover collapse, they often exclude sinkhole-specific damages.

- What to look for: Coverage for the cost of repairs to the foundation, home, and other structures, as well as content protection.

- Best Providers:

- Tower Hill Insurance: Offers comprehensive sinkhole insurance, including structural damage and remediation services.

- American Integrity Insurance: Provides sinkhole coverage as an add-on to homeowner’s policies with detailed assessments to mitigate risk.

5. Fire and Smoke Damage Insurance

Although less frequent, Florida is not immune to wildfires, particularly during dry seasons. Having protection against fire and smoke damage is essential to safeguard your property – Insurance in Florida.

- What to look for: Comprehensive coverage for fire damage to both the dwelling and personal belongings. Consider additional living expenses coverage if your home becomes uninhabitable.

- Best Providers:

- Farmers Insurance: Offers fire damage coverage with quick claims processing and flexible deductible options.

- Liberty Mutual: Provides comprehensive fire and smoke protection, with excellent customer service and policy flexibility.

6. Comprehensive Natural Disaster Insurance Bundles

Some insurance companies offer bundled policies that cover multiple natural disasters, which can simplify the process and potentially reduce costs.

Insurance in Florida – These packages can include coverage for hurricanes, floods, windstorms, and even fires or sinkholes.

- What to look for: Ensure the bundle covers the specific risks in your area, and review the deductible options for each type of disaster. It’s also important to confirm if the policy has any limits or exclusions.

- Best Providers:

- USAA: Known for its excellent customer service and comprehensive policies, USAA offers bundled disaster insurance for military families.

- Progressive: Provides multi-peril policies that can include hurricane, flood, and windstorm protection under one plan, simplifying the claims process.

7. Considerations for Choosing the Right Insurance

- Location-specific risks: Florida has unique geographic risks, so it’s essential to assess your specific location’s exposure to hurricanes, flooding, and sinkholes – Insurance in Florida.

- Cost of deductibles: Many natural disaster insurance policies come with high deductibles, especially for hurricane or windstorm coverage. Evaluate how much you’re willing to pay out-of-pocket in the event of a claim.

- Additional living expenses (ALE): Ensure your policy includes ALE coverage, which helps cover the cost of temporary housing if your home becomes uninhabitable.

- Reputation of the insurer: Choose an insurance provider with a strong reputation for handling claims efficiently and offering good customer service. In times of disaster, timely support can make all the difference.

Conclusion

When living in Florida, having comprehensive natural disaster insurance is not just a good idea—it’s essential.

From hurricanes and flooding to sinkholes and wildfires, protecting your property from these risks requires careful consideration of the right types of coverage.

Researching the best providers and policies ensures that you and your home are prepared for whatever nature throws your way.

By reviewing the top insurers and understanding the types of disaster coverage needed, you can make an informed decision that safeguards your property and gives you peace of mind.